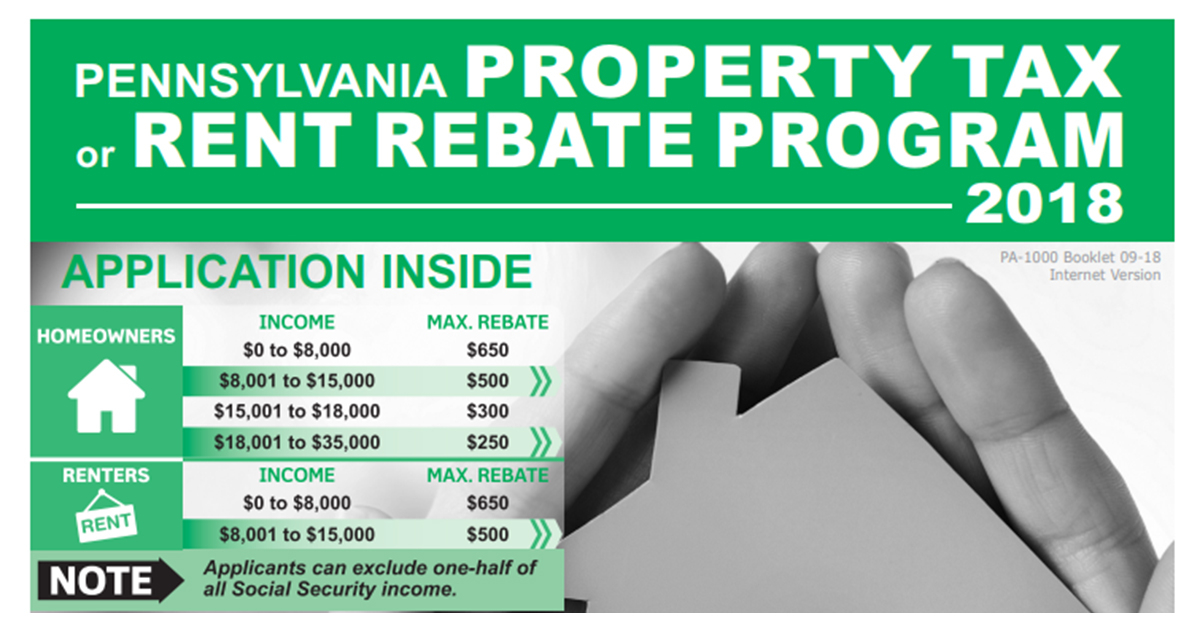

Rebate Property Tax – A Property Tax Rebate is available to property owners in Pennsylvania. This program can help reduce your property taxes and preserve your home. There are some requirements that you must meet to be eligible. You must have owned a property in the state or rented one for a certain amount of time, and have paid your taxes. If you’re renting a home, you must make sure that your landlord paid property taxes before you moved in. Social Security Disability cannot deny your eligibility for this program.

New York City property tax rebates

The city signed legislation that provides homeowners with one-time property taxes rebates. These rebates are worth up to $150 and will help homeowners with low or moderate incomes lower their tax bills. Some homeowners will receive the rebate automatically, while others will need to submit additional information.

Thousands of New Yorkers are expected to receive their checks in the coming weeks. Nearly two million checks will be sent out by the city in May. The legislation is bipartisan and was approved by the City Council earlier this month. It aims to help low and middle-income homeowners offset the effects of high consumer prices.

The $150 rebate will be given to hundreds of thousands of families who qualify for it. To be eligible, families must meet certain criteria. The Department of Finance will issue checks for those who meet the criteria. The income of a person and the type of their property determine eligibility.

To qualify for a property tax rebate, homeowners must have a lower-income than the average New Yorker. They must meet income requirements, which include not exceeding 6% of their adjusted gross income. New York is home to approximately 4.5 million homeowners.

Denver property tax relief program

Denver’s property tax relief program could offer homeowners and small-business owners the chance to reduce their property taxes. The Colorado Senate is currently considering a new bill that would lower the taxable value of residential and nonresidential property by $30000 and $10,000. This would result in a flat property tax rate that would benefit those who are low-income.

Whether you’re looking to buy a house or rent a home, rising property taxes and a competitive housing market can make it difficult to get a place to live. The City of Denver’s Property Tax Relief Program has expanded to assist more low-income residents with partial refunds of their property taxes. The program is aimed at homeowners and renters who earn up to 40% of the area median income (AMI). The city uses this figure to determine who qualifies. This figure would apply to a family of 2 and cost $26,000. For a family of three or four, the figure would be $32,000.

The Denver property tax relief program also benefits people in certain fields, such as psychologists, National guard members, and nonprofits. These people will receive temporary tax relief and financial assistance through the program.

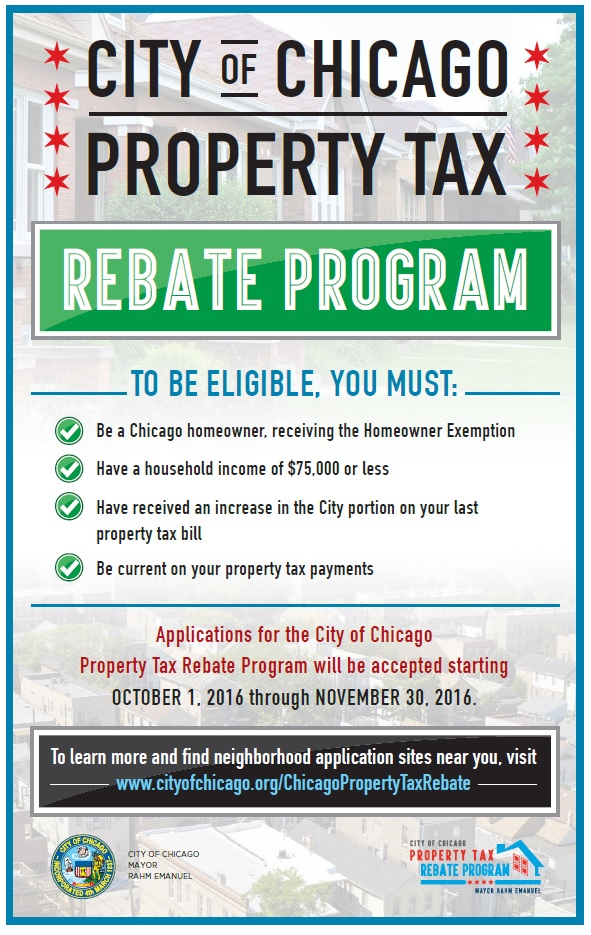

Rebate on Illinois property taxes

Whether you paid property taxes in 2020 or not, you may be eligible for an Illinois property tax rebate. You must have a household income of less than $500k, or 250k. You must also have been a resident of Illinois for at least two years to be eligible. To find out whether you qualify, fill out a rebate application and submit it to the Illinois Department of Revenue.

Rebates will be sent in the form checks to taxpayers who are eligible. A $50 rebate will be given to single taxpayers, and a $100 rebate for joint filers. If you have dependents, you will receive another $100 per person, up to a maximum of $300. For both single and joint filers, the rebate check should arrive within two months.

To apply for the rebate, you must file Form IL-1040 -PTR. The form must be submitted by September 12. Although the rebate may take several months, it will be available for eligible taxpayers as soon as possible. If you did not receive a refund last year, it may take longer. In addition, if you filed a paper check, it could take even longer to receive your rebate. Your submission will be reviewed by the state and you will receive your check.

If you qualify for Illinois property tax rebates, you will receive a credit equal to the amount of Illinois property taxes that you paid in 2021. You must have paid Illinois property tax in 2021 on your primary residence. If filing jointly, you must also have an adjusted gross income less than $500,000 to be eligible. You must have filed the IL-1040 by Oct. 17 to get the rebate.