Property Rebate Forms – A Property Rebate Form is an application for a tax refund that allows a taxpayer to avoid paying property taxes. The amount of property taxes due and the income of the owner will determine the rebate amount. Pennsylvania and other states offer additional incentives for lowering property taxes. If you are interested in applying for a property tax refund, you may want to start by educating yourself on how to fill out the form.

Eligibility for a property tax reduction based on income

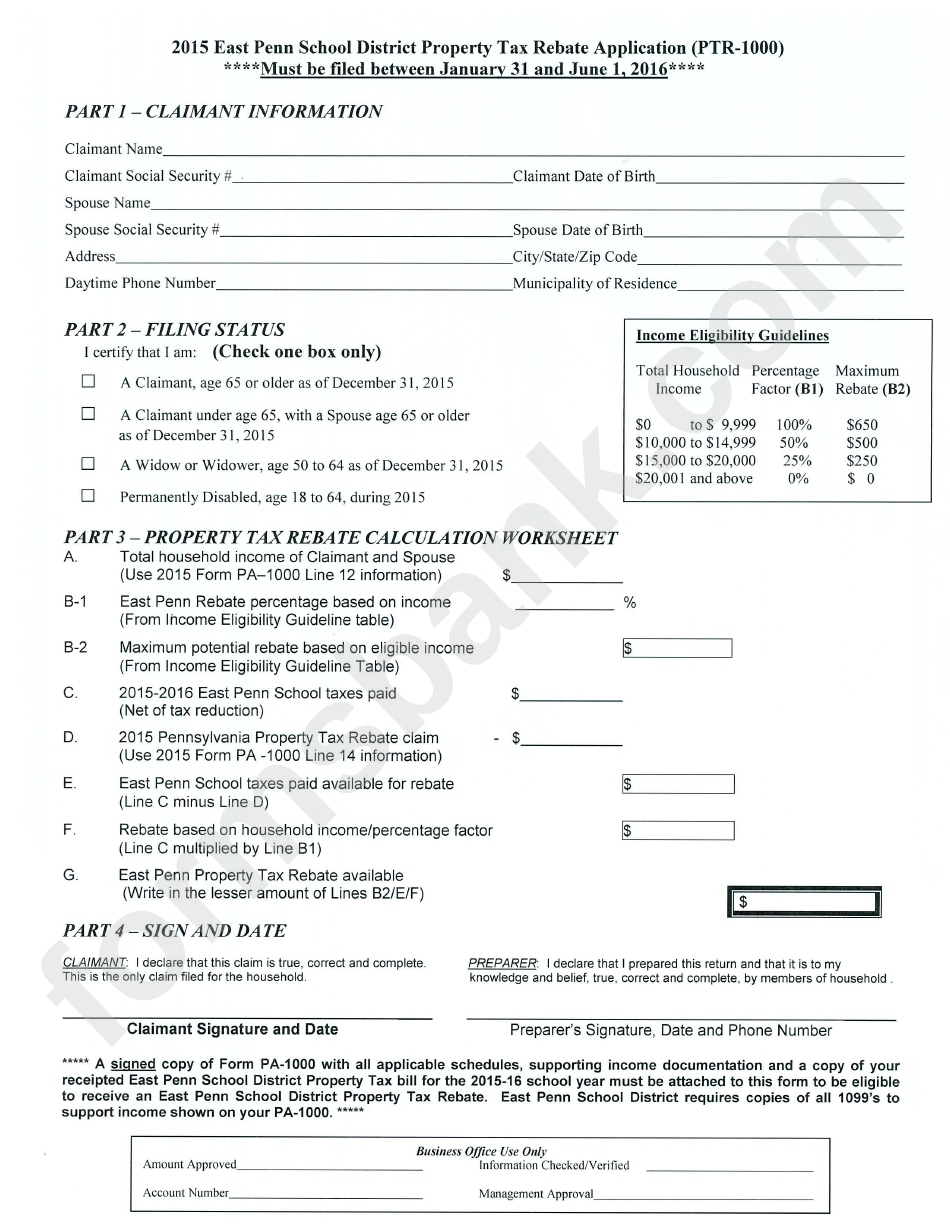

To determine if you are eligible for a property rebate, you will need to understand the income eligibility limits for your property. There may be income thresholds or requirements depending on where you live. In Maryland, for instance, you can’t qualify for a rebate if your income is over a certain threshold. Some jurisdictions offer relief for renters with lower incomes, and they may consider a portion of your rent as property tax.

A property tax rebate may be available to those who earn less than $250,000 per year. If you fall into this bracket, you can expect to receive a check for around $300 to $400 in return. The reduction will be greater if your income is more than this. If you lose more than $3,000, this amount will be added to your income.

You can choose to participate in a program to limit your property tax bill to four to five percent of your income. You may need to repay the tax relief if your property is sold. You can also choose to get $45,000 off the value of your property if you’re a veteran with a service-connected disability. However, this tax credit may only be valid for one year.

Methods for calculating a property-tax rebate

There are a number of ways to calculate your property tax rebate. The first is to determine the value of your property. This can be done in a variety of ways depending on the jurisdiction you live in. Add this number to the assessment rate. Each jurisdiction has a different one. This represents the percentage of your property value that is assessed for tax purposes. Let’s take, for example, $500,000 worth of property and an 8% assessment rate. Add the mill levy to your assessed value. This is the rate that represents the amount of taxes you owe the local government. The tax in this example would be $1800.

Generally, a property’s value is determined using the Unit Area Value System, which is an area-based tax valuation method. For instance, a city that uses the Unit Area Value System will calculate a property’s value based on its built-up area by calculating a per-unit price. This price is based on the expected return of a property in that city. This system is used in cities like Delhi, Bengaluru, and Hyderabad.

Pennsylvanians with disabilities and older citizens can access programs

There are many government programs and services available to assist older and disabled Pennsylvanians. For instance, the Supplemental Nutrition Assistance Program (SNAP) provides food vouchers and government assistance to low-income individuals and people with disabilities. These benefits can be used for groceries or other basic needs. Both individuals and their families can benefit from this government program.

The Pennsylvania Department of Aging administers these programs. They aim to protect the rights and welfare of older Pennsylvanians, promote healthy behaviors, prevent injury, and provide quality health care. PA 2-1-1 Northeast, a statewide program, is part of the national program. It provides support by phone, text, and web. The NEPA Aging Network Alliance (NANA) is an advocacy group founded in 2013 to increase awareness of the needs of older adults in Northeastern Pennsylvania. This is achieved through advocacy, coalition building, education, and networking.

Options Program is another program that provides assistance to older Pennsylvanians. This program is similar to the PA Older Americans Act, and provides assessments and services to those who qualify. Eligibility requirements include being a Pennsylvania resident, being in financial hardship and being at least 60 years old. Applications for the Options Program require applicants to show proof of income and assets. The financial information is used to determine cost sharing and sources of assistance.