Nyc Property Tax Rebate Checks 2023 – If you own a property in Pennsylvania, you can apply for a Property Tax Rebate. This program can help reduce your property taxes and preserve your home. There are some requirements that you must meet to be eligible. You must have owned a property in the state or rented one for a certain amount of time, and have paid your taxes. You must ensure that your landlord has paid the property taxes before you move in to a rental home. Social Security Disability cannot deny your eligibility for this program.

New York City property tax rebates

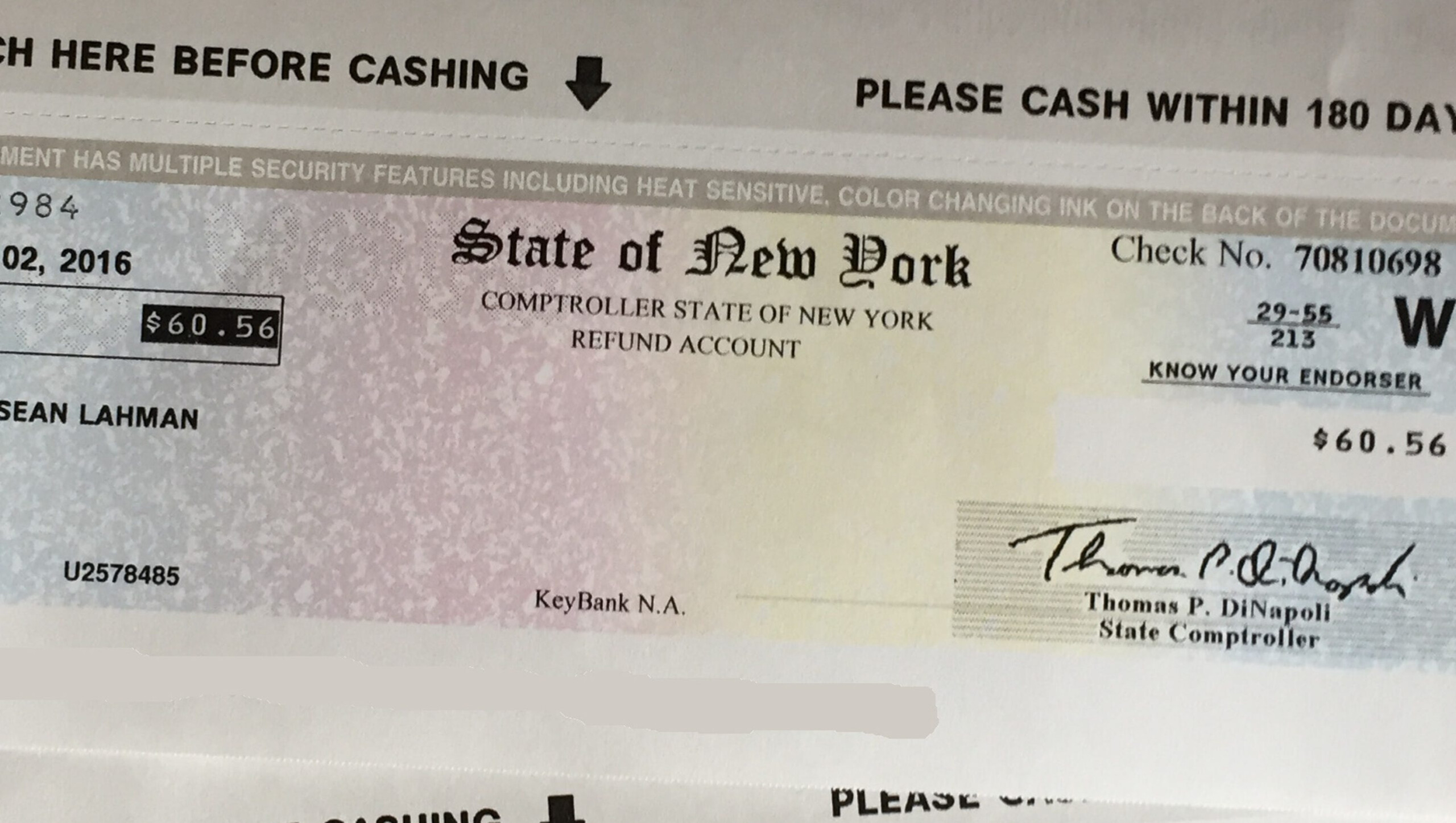

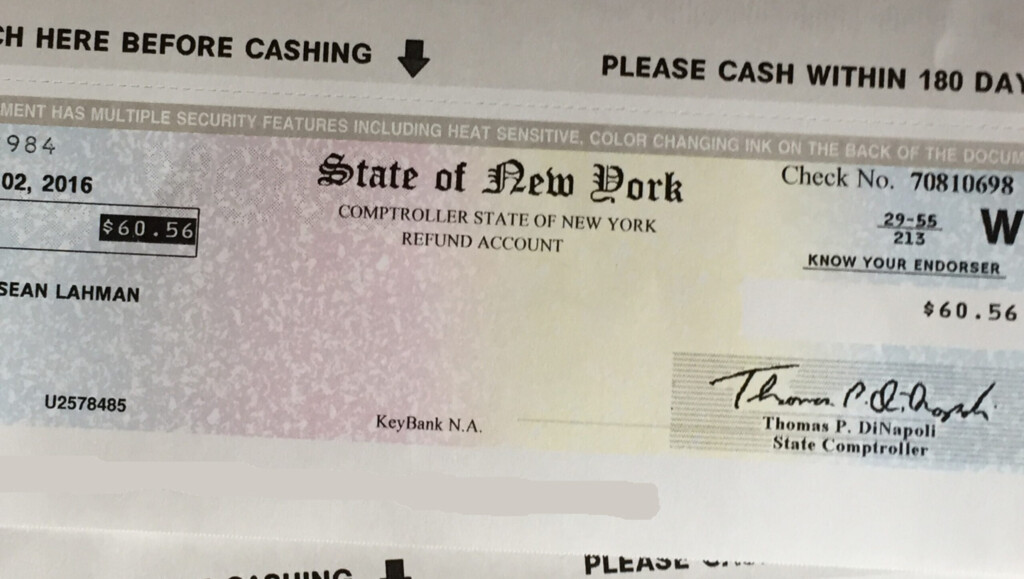

The city has signed legislation to provide one-time property tax rebates to homeowners who qualify for them. The rebates will be worth up to $150 and are intended to help homeowners with low and moderate incomes reduce their tax bills. Some homeowners will receive the rebate automatically, while others will need to submit additional information.

Thousands of New Yorkers are expected to receive their checks in the coming weeks. Nearly two million checks will be sent out by the city in May. The legislation is bipartisan, and was approved earlier this month by the City Council. It aims to help low and middle-income homeowners offset the effects of high consumer prices.

Families who are eligible for the $150 rebate will receive it in the form of a cash rebate. To be eligible, families must meet certain criteria. The Department of Finance will issue checks to those who qualify. Eligibility is based on a person’s income and type of property.

To qualify for a property tax rebate, homeowners must have a lower-income than the average New Yorker. They must also meet income requirements. These include not exceeding 6 percent of their adjusted gross earnings. New York has approximately 4.5 million homeowner-occupied homes.

Denver property tax relief program

Denver’s property tax relief program could offer homeowners and small-business owners the chance to reduce their property taxes. A new bill being considered in the Colorado Senate would lower taxable values for residential and nonresidential properties by $30000 and $10,000, respectively. This would lead to a flat property rate which would be beneficial for those with low income.

It can be difficult to find a place to call home, whether you are looking to purchase a house or rent one. Rising property taxes and a highly competitive housing market can make it hard to find a place to call home. However, the City of Denver’s Property Tax Relief Program is expanding to help more low-income residents get a partial refund of their property taxes. The program is aimed at homeowners and renters who earn up to 40% of the area median income (AMI). The city uses this figure to determine who qualifies. This figure would apply to a family of 2 and cost $26,000. The figure is $32,000 for a family with three or more members.

Denver’s property tax relief program is also beneficial to certain professionals, including psychologists, members of the National Guard, and non-profits. The program aims to give these people temporary tax relief, while also offering financial help.

Rebate on Illinois property taxes

You may be eligible for an Illinois property-tax rebate, regardless of whether you paid property taxes in 2020. You must have a household income of less than $500k, or 250k. You must also have been a resident of Illinois for at least two years to be eligible. To find out whether you qualify, fill out a rebate application and submit it to the Illinois Department of Revenue.

Rebates will be sent in the form checks to taxpayers who are eligible. Single taxpayers will receive a $50 rebate, while joint filers will receive a $100 rebate. Dependents will be eligible for an additional $100, up to $300, per person. The rebate check for single or joint filers should arrive within two to three months.

You should file Form IL-1040-PTR to apply for the rebate. The form must be submitted by September 12. Although the rebate may take several months, it will be available for eligible taxpayers as soon as possible. It may take longer if you have not received a refund last year. It may take longer if you submitted a paper check. Your submission will be reviewed by the state and you will receive your check.

If you qualify for Illinois property tax rebates, you will receive a credit equal to the amount of Illinois property taxes that you paid in 2021. You must have paid Illinois property tax in 2021 on your primary residence. If filing jointly, you must also have an adjusted gross income less than $500,000 to be eligible. To qualify for the rebate, you must have filed the IL-1040 before Oct. 17.