Property Tax Rebate Formfor New Brunswick

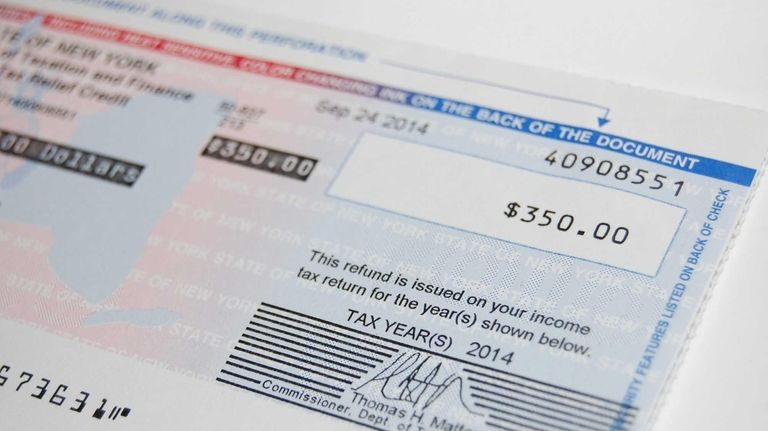

Property Tax Rebate Formfor New Brunswick – If you own a property in Pennsylvania, you can apply for a Property Tax Rebate. This program can help reduce your property taxes and preserve your home. However, there are a few requirements to be eligible. To be eligible, you must have owned or rented a property in … Read more