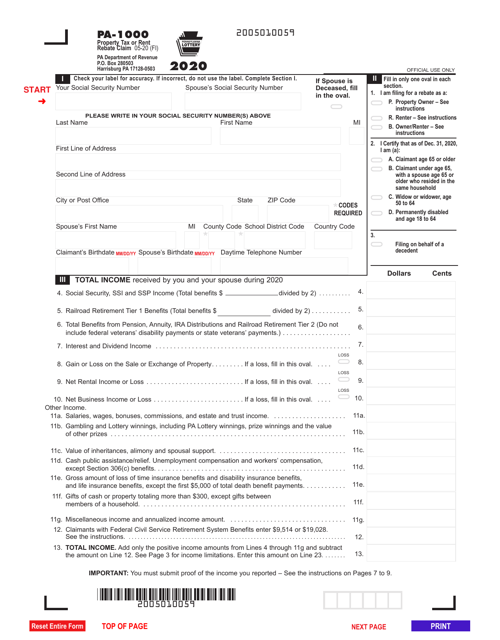

Pennsylvania Property Tax Rebate Form 2023

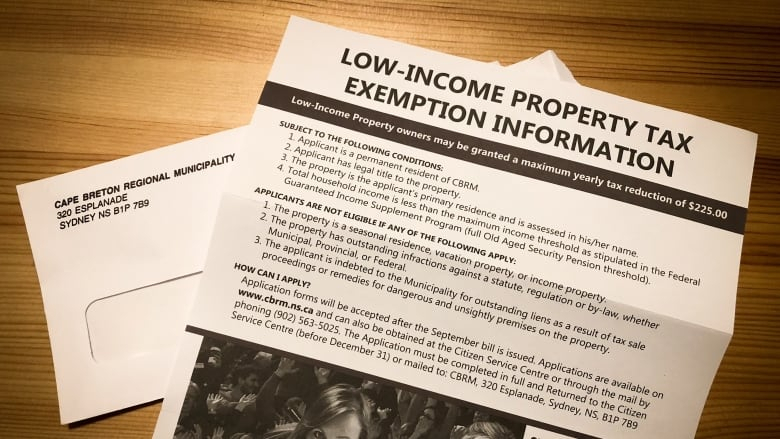

Pennsylvania Property Tax Rebate Form 2023 – A Property Tax Rebate is available to property owners in Pennsylvania. The program is a way to reduce your property tax bills and help you maintain your home. There are some requirements that you must meet to be eligible. You must have owned a property in the state … Read more