New York State Property Tax Rebates

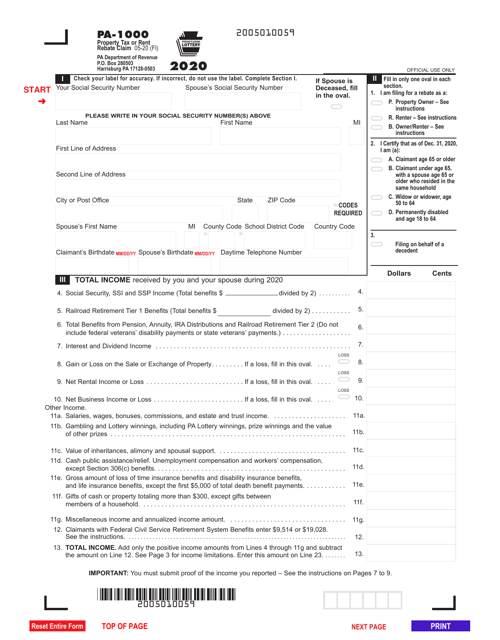

New York State Property Tax Rebates – A Property Tax Rebate is available to property owners in Pennsylvania. The program is a way to reduce your property tax bills and help you maintain your home. However, there are a few requirements to be eligible. You must have owned a property in the state or rented … Read more