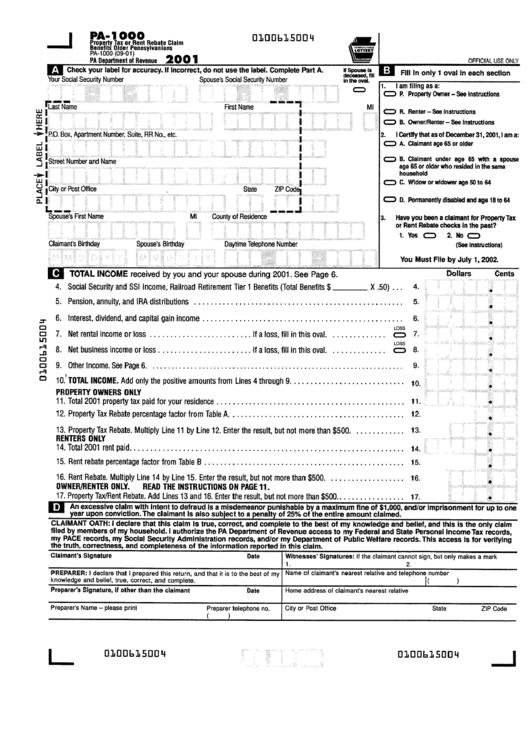

Pa Property Tax Rebate Deadline Extended 2023

Pa Property Tax Rebate Deadline Extended 2023 – If you own a property in Pennsylvania, you can apply for a Property Tax Rebate. This program can help reduce your property taxes and preserve your home. However, there are a few requirements to be eligible. To be eligible, you must have owned or rented a property … Read more