Property Tax Rebate 2023

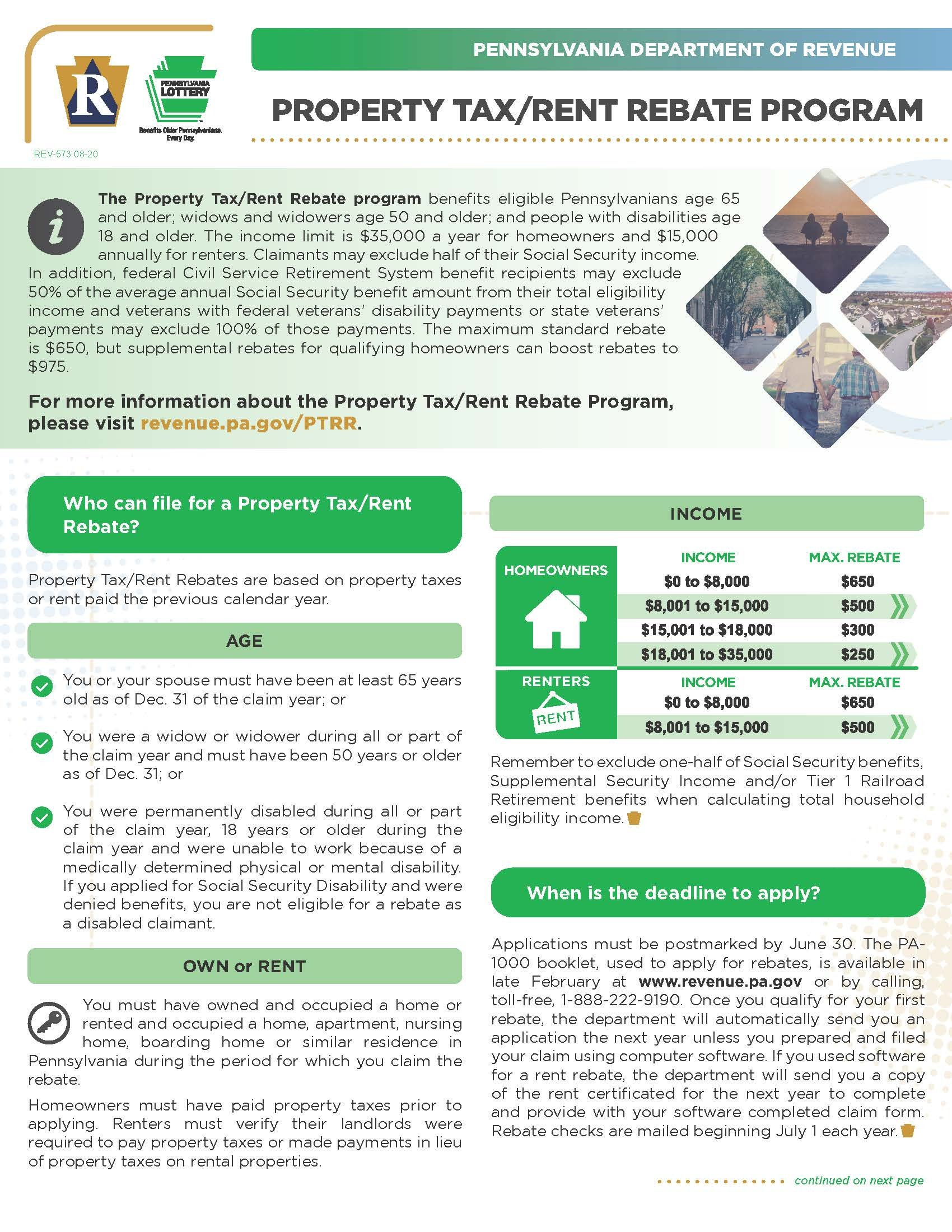

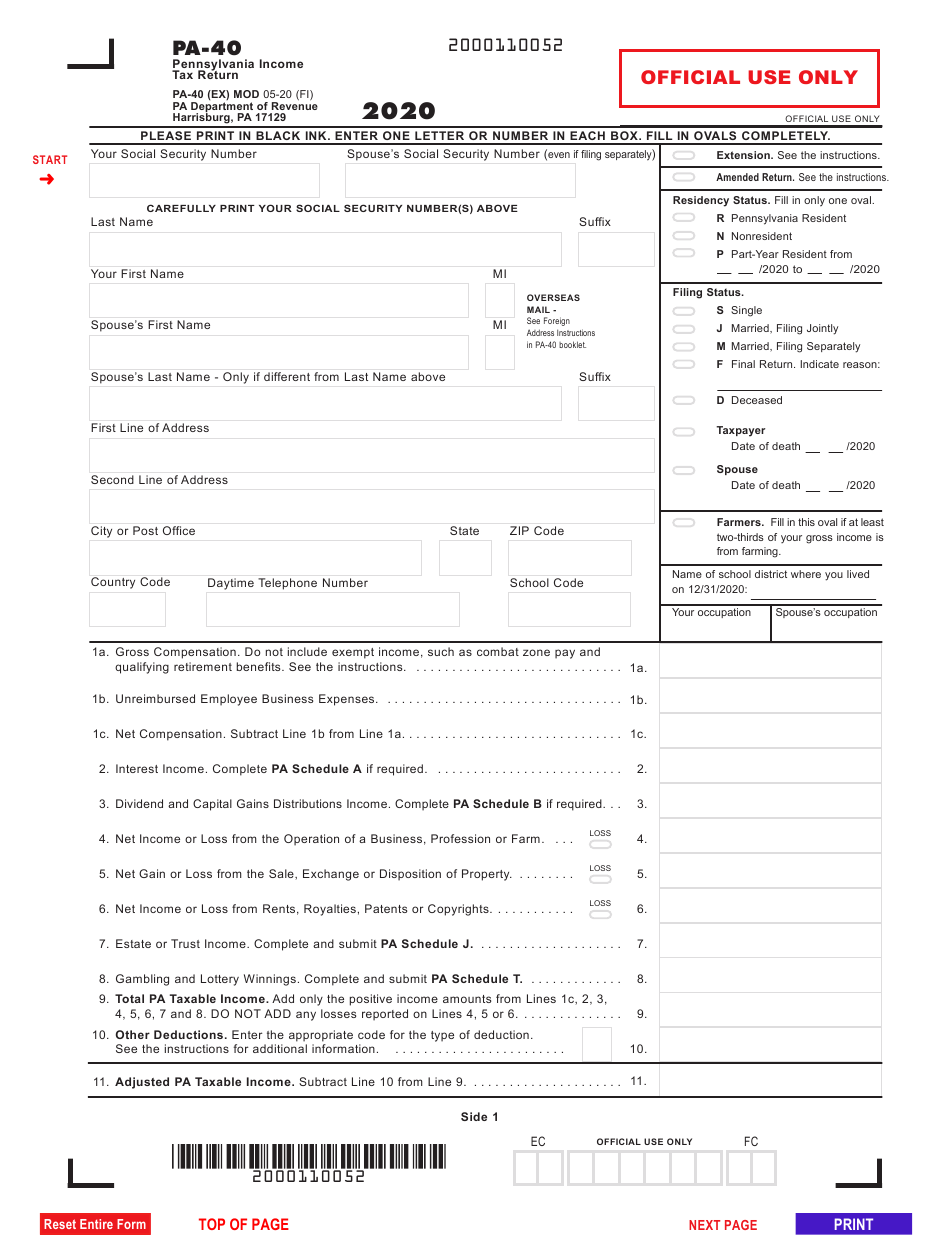

Property Tax Rebate 2023 – A Property Tax Rebate is available to property owners in Pennsylvania. The program is a way to reduce your property tax bills and help you maintain your home. However, there are a few requirements to be eligible. To be eligible, you must have owned or rented a property in the … Read more