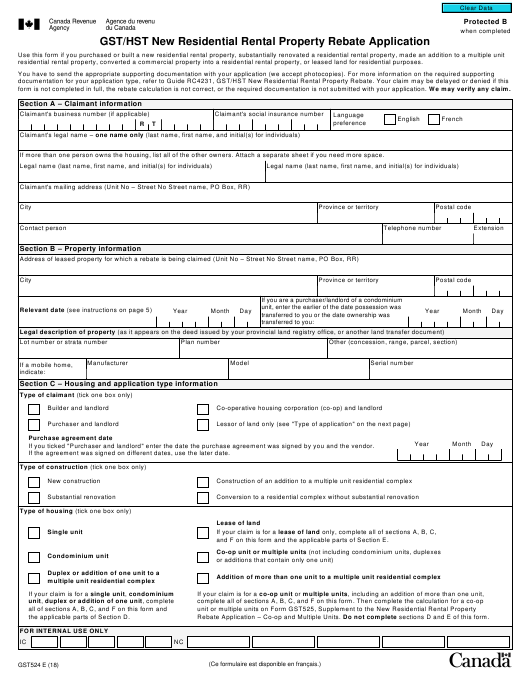

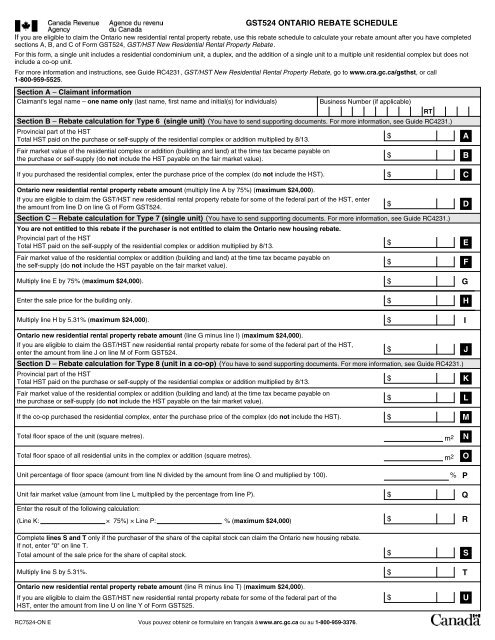

Gst524 Gst Hst New Residential Rental Property Rebate – The New Property Rebate is a great incentive for those who are considering buying a home. There are a few conditions that must be met to claim this rebate. You must first ensure that the property you are looking to purchase is eligible. The price of your home will determine the amount of rebate.

GST/HST

If you’re planning to buy a new home, you may qualify for a GST/HST new property rebate if you meet certain conditions. First of all, you must be the primary owner of the house. The new house must not exceed $450,000 in price. This includes the amount you paid to assignors who will be subject to GST/HST.

To apply, you’ll need to fill out two forms that you can find on the government’s website. The application form and the rebate amount will be calculated using one of the forms. These forms will need to be mailed to the tax center.

Duplexes

Duplexes are two units of a building that have the same legal title but do not include separate legal titles. This type of structure can also consist of a single-family house with separate apartment. Duplexes are not eligible to receive the GST/HST residential rental property rebate, unlike condominiums.

Conditions to claim a rebate

You may be interested in the Conditions for Claiming A New Property Rebate if you’re looking to purchase a new house. This tax credit is offered to first-time home buyers in Ontario. This tax credit will help you pay your mortgage off faster. If you are planning to claim this credit, you need to make sure that you meet all the requirements.

In order to qualify, you need to be the one who built the house, or engaged someone else to do it for you. This is important, because if you do not pay for the work yourself, you may be asked to pay the rebate back. A rebate can only be claimed once per house. You cannot claim the rebate twice if you are planning to perform additional work on your home.

Filing deadline

The deadline to file for a rebate for new property depends on the rebate you apply for. Important to remember that this rebate is not the same as claiming your ITCs. The rebate can only be applied to the purchase of a new property.

When you purchase a new property, you may be eligible for a rebate based on the GST/HST you paid on the land and house. You may also be eligible for a rebate depending on the GST/HST paid on the construction of your new home.