Nys Property Rebate Checks – You may be eligible for a bonus property-tax rebate if you reside in Pennsylvania. This rebate will be based on the taxes that you have paid on your property or on rent in the past calendar year. You can check if you qualify for this bonus rebate online by inputting your zip code and the school district that you live in.

New York’s budget includes homeowner tax relief for middle-income homeowners

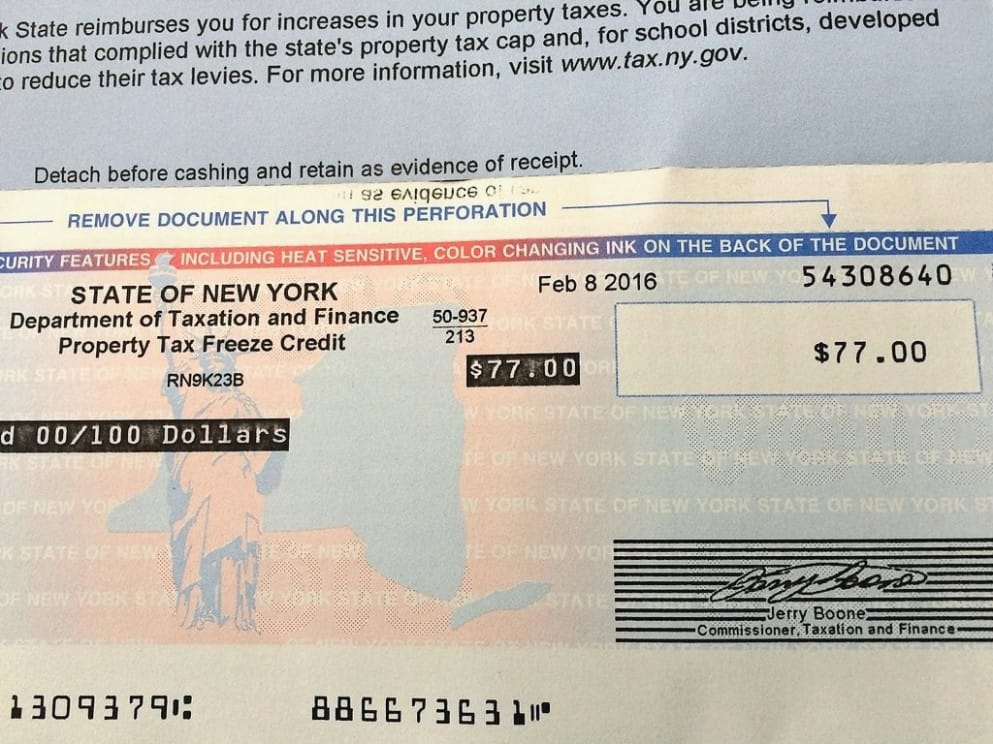

New York announced a homeowner tax relief plan for homeowners with low and middle incomes. This program is designed to help homeowners pay their property taxes while still living comfortably. The homeowner’s income, local property taxes and property taxes will all affect the amount of the rebate. It can range from $100 to $2,000. It is estimated that 480,000 homeowners will benefit from the program.

The budget includes $2.2 billion in property tax rebates, which would be available starting this fall. It also includes $162 million in tax cuts for middle-income homeowners. However, there are a number of concerns with the proposal. Advocates for criminal justice reforms claim that the plan will place more poor people in prison.

The state will offer a $200 property tax rebate to middle-income homeowners. Low-income households will also be eligible for an additional property tax rebate under the new state budget. This rebate will be a portion of the STAR benefits that these homeowners have already received.

While California’s budget was released on June 30, New York’s budget is still under review. The budget includes large increases in health and education aid, bonuses for health care workers, and large set-asides of cash reserves for future needs. The state budget has a few policy changes, but the biggest benefit is to homeowners and car owners.

Tax relief for homeowners is based upon taxes paid in the previous calendar year or included in rent

To qualify for homeowner tax relief you must have a certain net income and have paid property tax on your principal residence during the previous calendar year. This amount cannot exceed 6% of your adjusted gross income. You can also qualify for a property tax credit if you pay less than that amount and rent your home in the same year. Tax season is the best time to apply tax relief for homeowners.

Pennsylvanians are eligible for a bonus rebate

Recently, the Pennsylvania Department of Revenue announced that certain property owners are eligible for a one-time bonus rebate on property taxes. This bonus rebate will be equal to 70% of the original rebate amount. Pennsylvanians can apply online for their rebate through myPATH if they are eligible. There is no need to create an account to apply. Alternatively, claimants can print out a paper application and submit it to the Department of Revenue.

Pennsylvanians must have a minimum income to be eligible. Renters have to earn $15,000 per month, while homeowners must make $35,000 per year. Income is also half of Social Security. This program will be of benefit to approximately 400,000- 450,000 Pennsylvanians each year. Many applicants may expect a direct deposit to their bank account, while others will receive a check in the mail.

Pennsylvania legislators have asked the government to increase the rebate amount for those who are eligible. More than two dozen bills have been introduced by the state to increase or reverse the freezing of the rebate. But the bills have not been successful. State Rep. Michael Peifer, who pushed the bill in the state House, did not respond to interview requests.

The government is looking at a plan to transfer lottery money to older residents. However, advocates say the state must fully fund the lottery programs before making the transfers. Moreover, the lottery was created to provide extra benefits to older residents, not to prop up the state budget. However, legislators are racing against the clock to decide on the issue.