Pa1000 Property And Rent Rebate Form – Property Tax/Rent Rebate is a program that helps financially poor Pennsylvanians. Governor Tom Wolf proposed that eligible borrowers receive one-time bonuses. This proposal is meant to make it easier for people in need. The application is free. But before you apply, make sure you read the eligibility requirements carefully.

Once-off bonus rebate

Tom Wolf, the governor of Pennsylvania has proposed a one time bonus rebate to Pennsylvania residents who claim Property Tax/Rent Rebate. This proposal is intended to help vulnerable residents who are in financial hardship. In September, the money will be transferred to residents’ bank accounts. The bonus rebate amounts will range from 175 to 455 dollars, depending on income. The rebates will be funded by $140 million in federal ARPA funds.

Pennsylvania taxpayers who were approved for a property tax/rent rebate in 2021 will automatically receive a one-time bonus rebate before the end of the year. This one-time bonus rebate will be equal to 70% of the original rebate amount. The bonus rebate will be issued in the same manner as the original rebate.

Since the application process is automatic, there is no need to fill out any additional forms or submit any additional documents. The Department of Revenue will process your application for the 2021 rebate automatically. Once your application is approved, the bonus rebate will be deposited to your bank account. It will be paid in the same manner as the original rebate.

Free application process

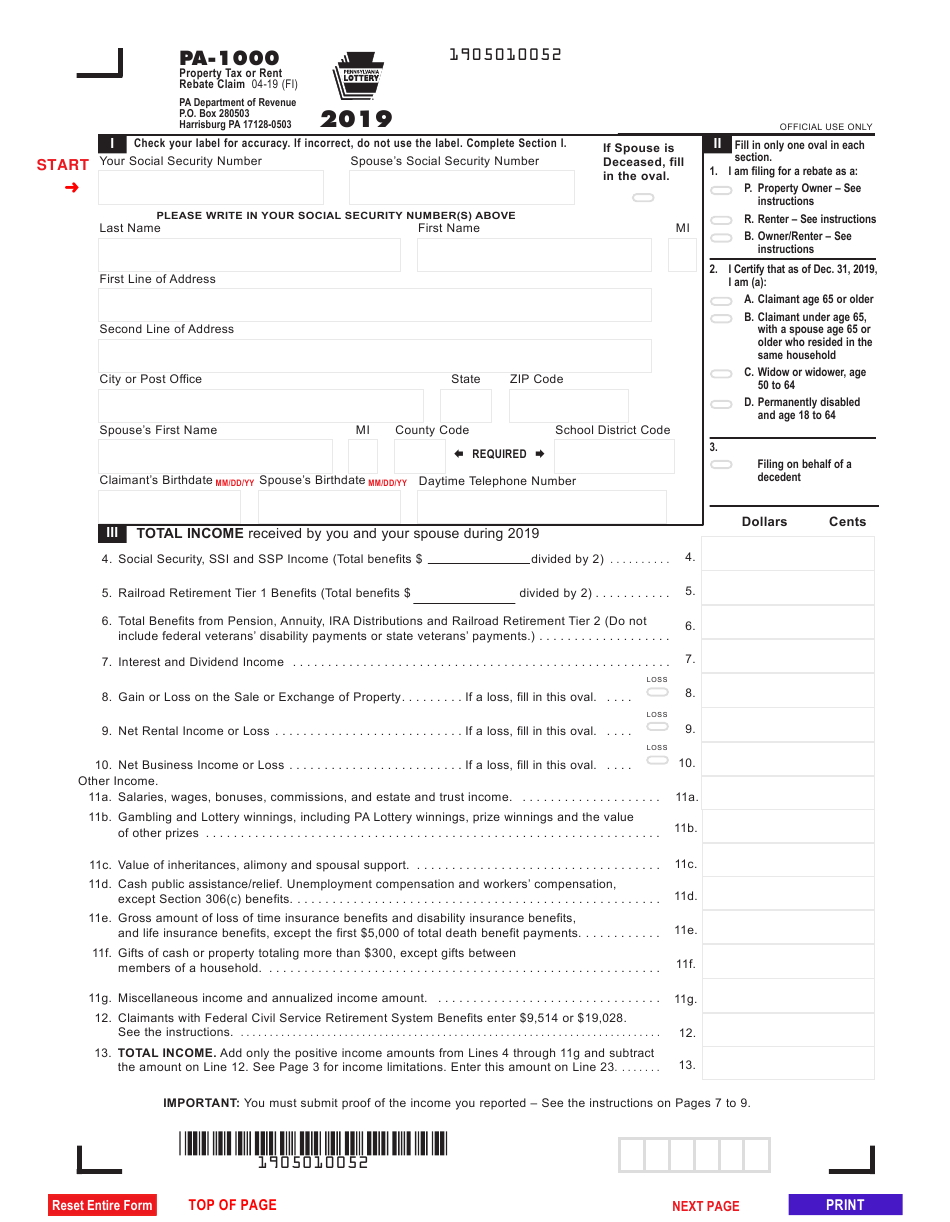

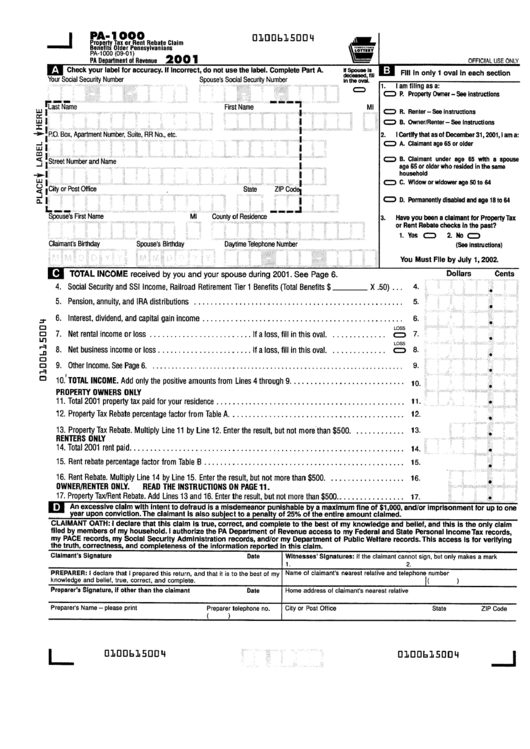

The Department of Revenue provides a free application process to claim a property tax/rent rebate. Applicants can apply online using myPATH and they will be contacted when their claim posts and is approved. Applicants can also call the Department of Revenue to check on the status of their application. Once the process is complete, the Department of Revenue will mail out their rebate to them.

Funding source

The Pennsylvania Housing Finance Agency administers the Property Tax/Rent Rebate program. It is designed to reduce property taxes for homeowners and developers. The program is available for those who are eligible to receive a property rent rebate and who can show proof of eligibility. The funding is available in two forms: tax credits and rental rebates. Tax credits are awarded to those who pay more than the maximum monthly amount, while rent rebates are granted to those who pay less.

Since its inception in 1962, Pennsylvania’s Property Tax Rent Rebate Program (PATR) has distributed more than $7 billion worth of property tax refunds to Pennsylvanians over the years. The program is not keeping up with inflation. As a result, Pennsylvania lawmakers have called on the General Assembly to use some of the remaining money from the American Rescue Plan to continue the property rent rebate program.