Property And Rent Rebate Pa – The Property Tax/Rent Rebate program is designed to help financially struggling Pennsylvanians. Governor Tom Wolf proposed that eligible borrowers receive one-time bonuses. This proposal is meant to make it easier for people in need. It also offers a free application process. But before you apply, make sure you read the eligibility requirements carefully.

Once-off bonus rebate

Tom Wolf, the governor of Pennsylvania has proposed a one time bonus rebate to Pennsylvania residents who claim Property Tax/Rent Rebate. This proposal is intended to help vulnerable residents who are in financial hardship. The money will be deposited into residents’ bank accounts in early September. The amount of the bonus rebate will vary depending on your income. It can range from 175 up to 455 dollars. The rebates will be funded by $140 million in federal ARPA funds.

Pennsylvania taxpayers who were approved for a property tax/rent rebate in 2021 will automatically receive a one-time bonus rebate before the end of the year. This one-time bonus rebate will be equal to 70% of the original rebate amount. The bonus rebate will be issued in the same manner as the original rebate.

The application process is automated so you don’t need to complete any additional forms. The Department of Revenue will process your application for the 2021 rebate automatically. Once approved, the one-time bonus rebate will be deposited into your bank account. It will be paid in the same manner as the original rebate.

Free application process

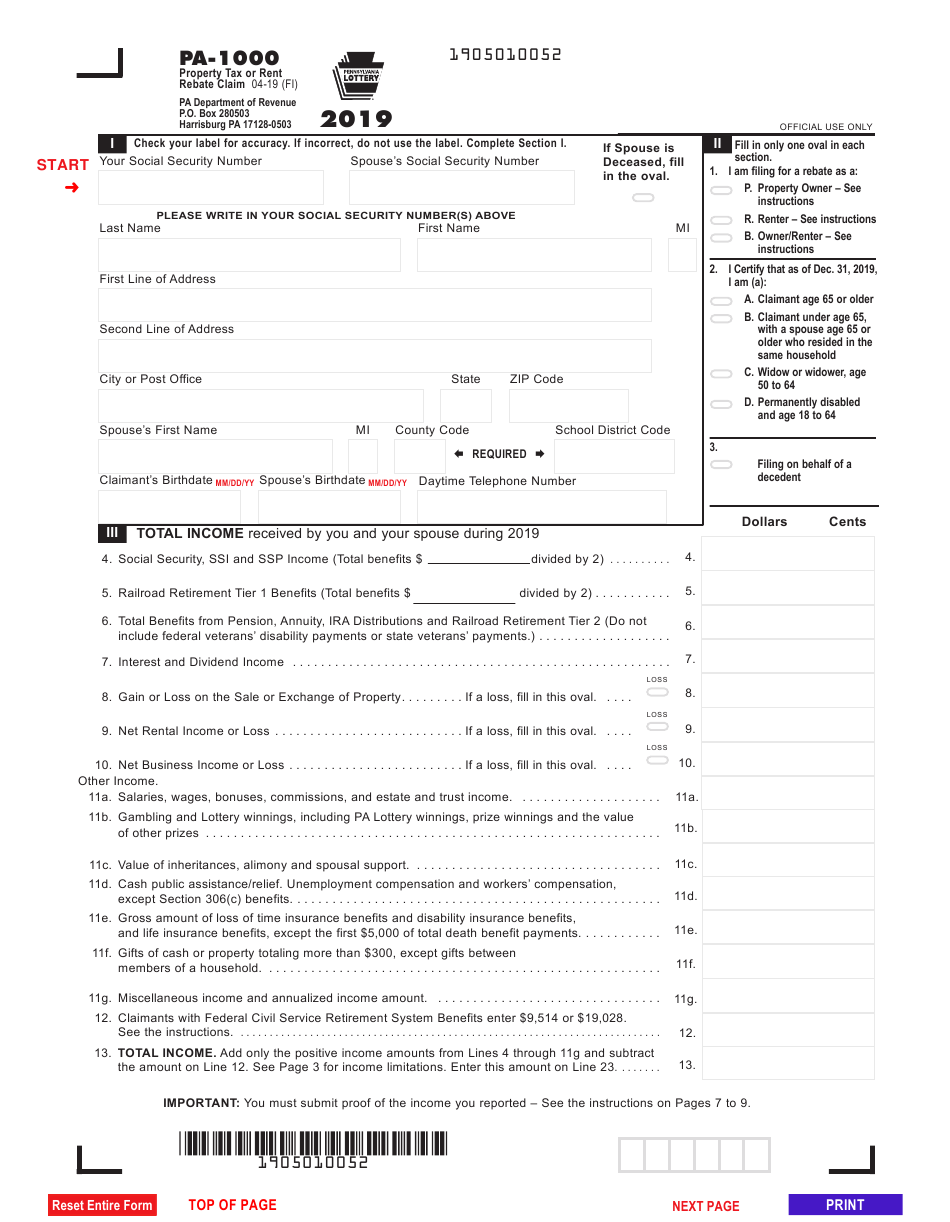

The Department of Revenue provides a free application process to claim a property tax/rent rebate. Apply online via myPATH. They will be contacted once their claim is posted and approved. Applicants can also call the Department of Revenue to check on the status of their application. Once the process is complete, the Department of Revenue will mail out their rebate to them.

Funding source

The Pennsylvania Housing Finance Agency administers the Property Tax/Rent Rebate program. It is designed to reduce property taxes for homeowners and developers. All persons who are eligible for a property rent rebate can apply and must show proof of their eligibility. There are two options for funding: tax credits or rental rebates. Rent rebates are available to those who have less than the monthly maximum, and tax credits are given to those who have to pay more.

Pennsylvania’s Property Tax Rent Rebate Program has provided more than $7 billion in property tax refunds to older adults and disabled persons in Pennsylvania since it was established in 1962. However, the program is struggling to keep pace with inflation. As a result, Pennsylvania lawmakers have called on the General Assembly to use some of the remaining money from the American Rescue Plan to continue the property rent rebate program.