Property Rebate Checks – You may be eligible for a bonus property-tax rebate if you reside in Pennsylvania. This rebate will be based on the taxes that you have paid on your property or on rent in the past calendar year. Online, enter your zip code and select the school district where you live to determine if you are eligible for this bonus rebate.

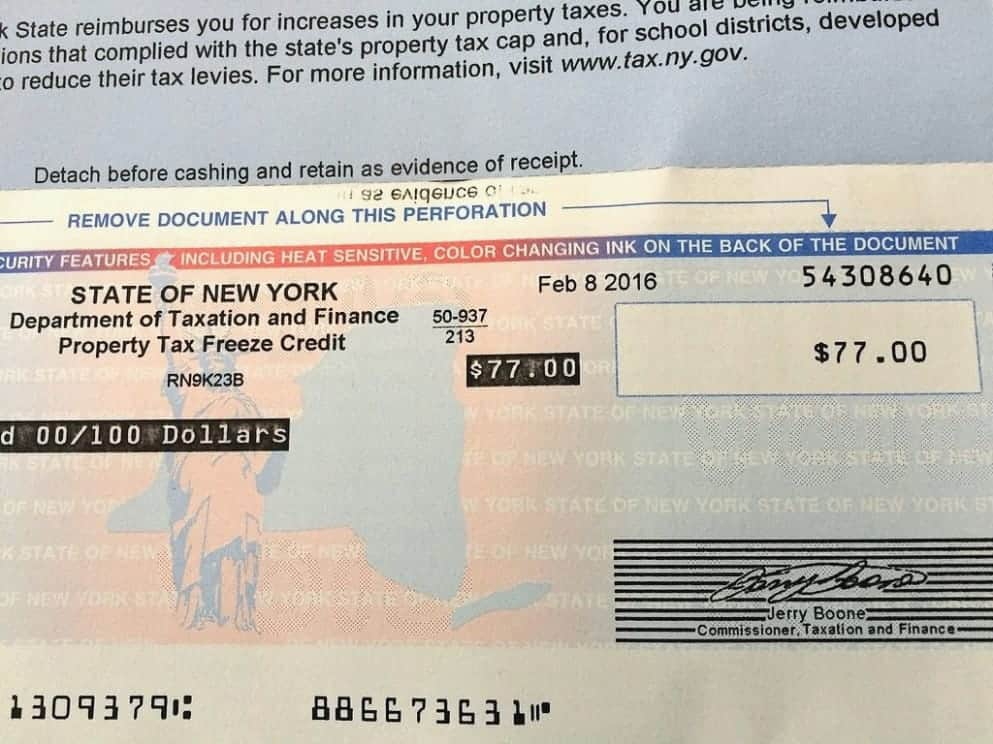

New York’s budget includes homeowner tax relief for middle-income homeowners

New York announced a homeowner tax relief plan for homeowners with low and middle incomes. The program helps homeowners to pay their property taxes and still live comfortably. The homeowner’s income, local property taxes and property taxes will all affect the amount of the rebate. It can range from $100 to $2,000. The program is expected to benefit 480,000 homeowners.

The budget includes $2.2 billion in property tax rebates, which would be available starting this fall. It also includes $162 million in tax cuts for middle-income homeowners. There are some concerns about the proposal. Advocates for criminal justice reforms claim that the plan will place more poor people in prison.

The state will offer a $200 property tax rebate to middle-income homeowners. Low-income households will also be eligible for an additional property tax rebate under the new state budget. The rebate is a percentage of the STAR benefits already received by these homeowners.

While California’s budget was released on June 30, New York’s budget is still under review. The budget includes large increases in health and education aid, bonuses for health care workers, and large set-asides of cash reserves for future needs. The state budget has a few policy changes, but the biggest benefit is to homeowners and car owners.

Homeowner tax relief is based on taxes paid or included in rent in previous calendar year

To qualify for homeowner tax relief you must have a certain net income and have paid property tax on your principal residence during the previous calendar year. This amount cannot exceed 6% of your adjusted gross income. If you rent your home and pay less than this amount, you may be eligible for a property credit. Tax season is the best time to apply tax relief for homeowners.

Pennsylvanians are eligible for a bonus rebate

The Pennsylvania Department of Revenue recently announced that certain property owners in the state are eligible to receive a one-time bonus rebate on their property taxes. The bonus rebate will equal 70% of the original rebate amount. Pennsylvanians can apply online for their rebate through myPATH if they are eligible. To apply, you don’t need an account. Alternatively, claimants can print out a paper application and submit it to the Department of Revenue.

Pennsylvanians must have a minimum income to be eligible. The minimum income for renters is $15,000 and $35,000 for homeowners. Income is also half of Social Security. This program will be of benefit to approximately 400,000- 450,000 Pennsylvanians each year. Some applicants will be able to expect a direct bank deposit to their bank account. Others will receive a check by mail.

Pennsylvania lawmakers have pushed the government to increase the rebate for those who qualify. The state has introduced more than two dozen bills to increase the rebate amount or reverse the freeze. The bills have not been passed. State Rep. Michael Peifer, who pushed the bill in the state House, did not respond to interview requests.

The government is considering a plan to transfer lottery funds to services for older residents. However, advocates say the state must fully fund the lottery programs before making the transfers. The lottery was not created to support the state’s budget, but to provide additional benefits for older residents. Nonetheless, lawmakers are racing against time to make a decision on the issue.